Trauma Insurance – Linked vs Stand-Alone Policies

Trauma cover is all about supporting your recovery from a serious illness – helping you afford the treatment of your choice and allowing you to make necessary changes to your lifestyle. When you’re looking at trauma cover, there are 3 key things you need to understand so you know what you’re covered for, and what that means at claim time:

- What you can claim for – Trauma definitions

- How your cover is structured – Stand-alone or linked

- Making multiple claims – Trauma reinstatement

Linked Cover vs Stand-alone Cover

Trauma cover may be purchased as a stand-alone policy or as a ‘linked policy’ connected to life cover or TPD cover.

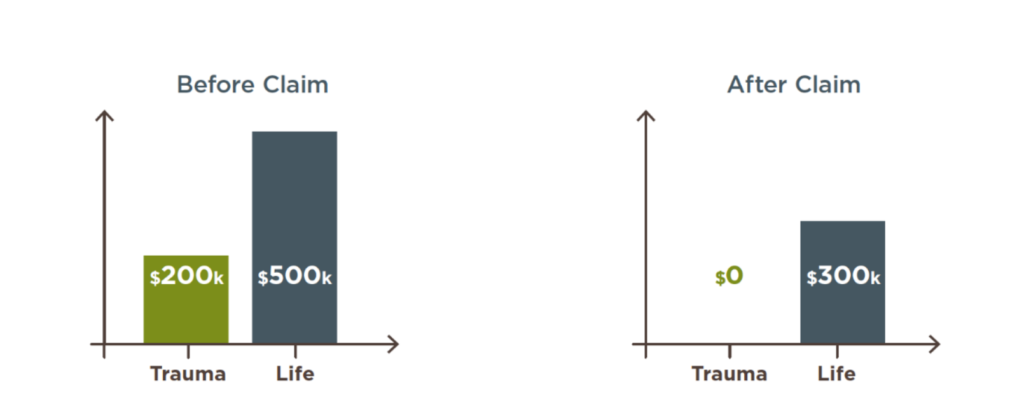

Generally linking policies reduces premiums, but there are implications at claim time. Say you have a $200,000 trauma cover policy linked to a $500,000 life cover policy. If you make a successful claim on your trauma cover, your life cover benefit will reduce by the $200,000 paid out (i.e. to $300,000).

Trauma Insurance – Before and After Claim

Depending on your situation you may be eligible to buy back this extra life cover at some point, but it’s important to note that your life cover is significantly reduced in the meantime.

Did you know?

There’s a common exclusion on trauma cover policies that means you generally won’t be covered for some medical conditions if they’re first diagnosed within 90 days of receiving your application. Also you are likely to not be covered for any conditions that directly or indirectly arise from an intentional act or omission. You can find details of any exclusions in your Product Disclosure Statement (PDS).

Want to know more?

If you’d like to discuss any of the content in this article and how it may apply to you, or even if you want more information, please call me on 0418 431 079.

Leave a Reply