The Market Will Do Whatever It Has To Do To Fool The Majority Of Participants

September 2022 Market Brief

This market updates comes thanks to Jody Elliss. Jody is currently the CEO and Head of Research for Investor Centre and is one of Australia's leading stock market analysts, supplying information and services to 12 Australian and 4 international institutions including Comsec, Halifax, and Macquarie.

Market Brief

The market continues to behave in a highly unpredictable manner.

We are currently in an accelerated global interest rate climb that is unprecedented in history. The World Bank stated before Covid that all major economies would have a zero-interest rate by 2025 as many economies were expected to be in surplus.

This all changed with Covid as world economies went into heavy deficit. In their all- seeing wisdom, as debt increased dramatically, the World Bank declared a huge inflationary trend. It and it must raise interest rates to counter the inflationary effect.

The Reserve Bank of Australia has stated that interest rates will need to approach 3% before any downturn can be expected.

However, the US federal reserve has stated that to gain any leverage on economic stimulus by cutting rates – the rates must reach above 5% in 2023.

This makes the RBA target very low indeed and unlikely to pause for long at 3%.

Interest Rate Effect

An aggressively rising interest rate should see a strengthening of the underlying currency. When we have all our commodities measured in $USD, and the $USD is rising with the climbing interest rate – we see the commodity prices weaken.

The resultant of the current US interest rate rise to 2.5% is:

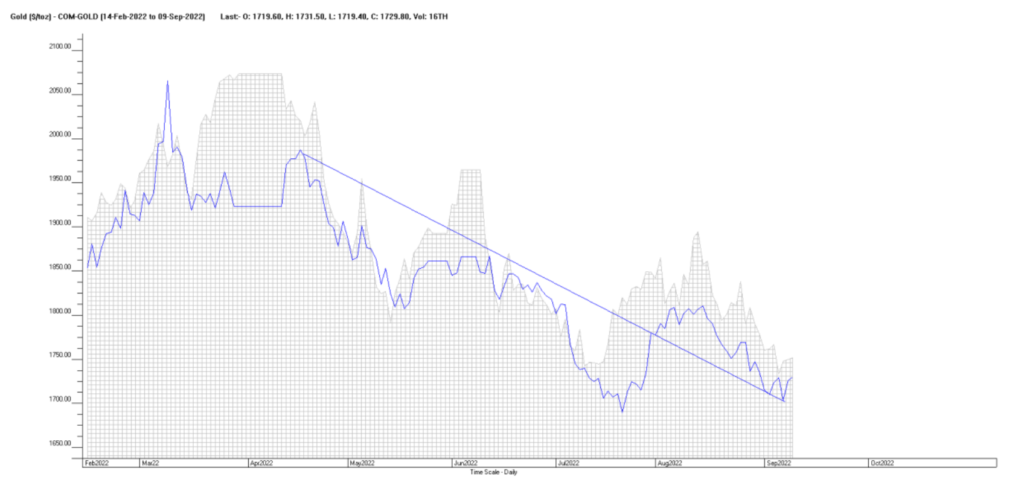

Gold has fallen 15% to $1,700 Oil has fallen 30% to $85.

Further interest rate rises to 5% will see:

Gold to Fall below $1,600 Oil to fall below $70.

This all seems counter-intuitive to the war in the Ukraine and severe energy shortages in Europe. This also puts our crash table in conflict with Oil falling BUT Gold expected to rise in economic turmoil.

Another interesting component for us is that despite the RBA raising our interest rates

– it has not reflected in the strength of the $AUD which is in a strong downward trend, and it did NOT respond to the last RBA rate increase.

Gold Price plotted against $AUD-$USD. $AUD weakens against a rising $USD and the movement in Gold replicates the relative shift in currency value.

Market Quirks

Another quirk in the US market has been that until 2022, the US market has been predisposed to not move more than 1% on a Friday night either up or down. This has been the basic rule since 2008. However, this year we have seen five falls of greater than 2% (crash down) on a Friday night and two 2% moves up (crash up). This is indicative of institutional movement to displace the market.

In other words:

“The market will do whatever it has to do to fool the majority of participants”

Hence, we have seen the US market rally on the last interest rate rise as did Australia the rise before last. Fundamentals are NOT working for traders and investors currently.

Any significant news in the UK about the Royal family has historically seen a fall in the UK market. The recent demise of the Queen saw the FTSE 100 rally 2% and like everything else at present – seems to have had an opposite reaction.

Indices

All indexes except for CHINA are facing down and expected to slump into October. In saying that, China is having a temporary lull in a long-term downtrend. These are expected to continue into October – a traditional crash month – especially in the 7- year cycles.

Leave a Reply